what is fsa/hra eligible health care expenses

1 800 88CIGNA 882-4462 Behavioral. Not all expenses are eligible under all plans.

Hra Vs Hsa What You Need To Know Wex Inc

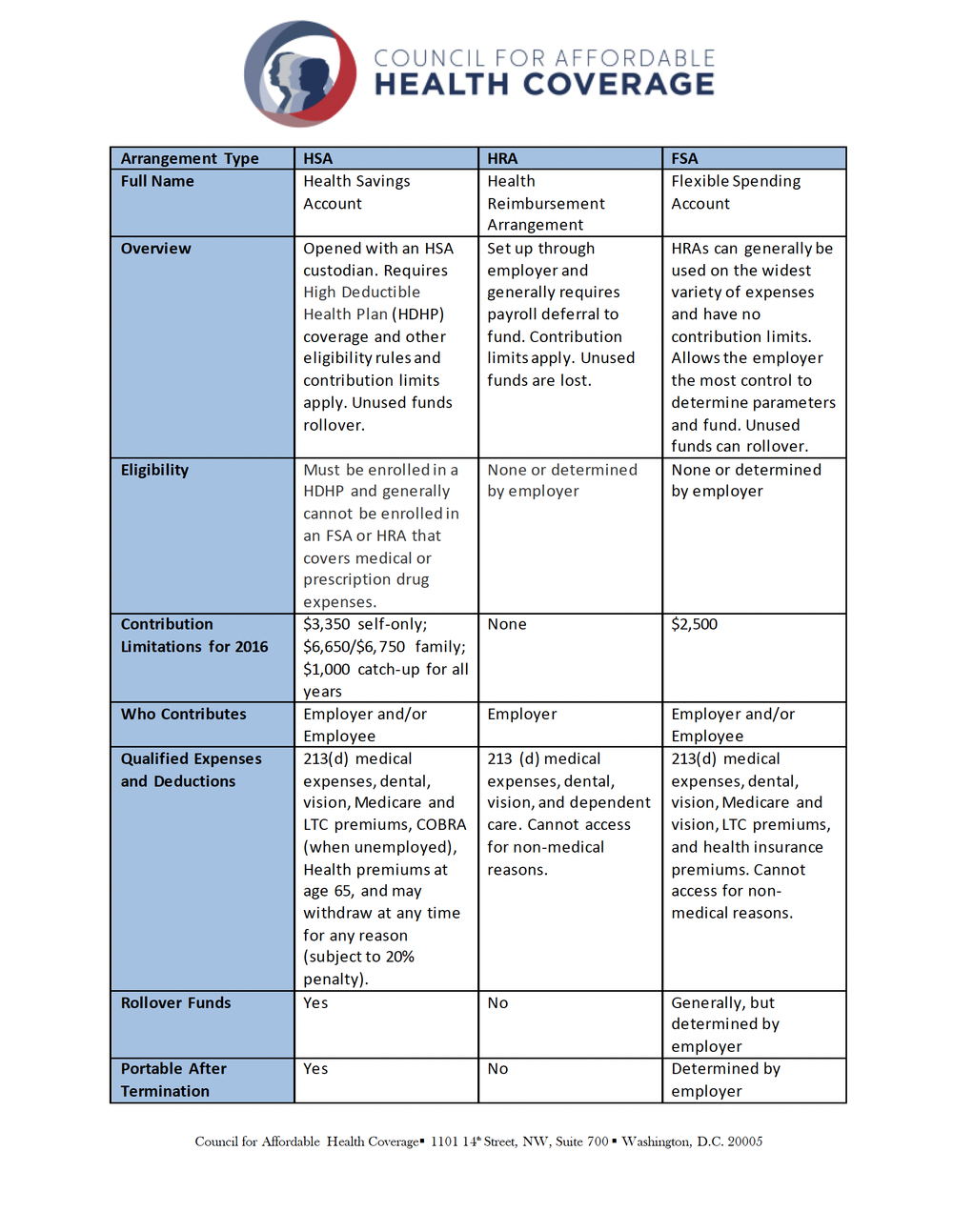

Please note that eligible expenses for a traditional HRA are determined at the discretion of the Employer toward these categories.

. 502 should not be used as the sole determinant for whether an expense is reimbursable by a health FSA or HRA or eligible for tax-free distribution from an HSA. When you visit the doctor the HRA can be used to pay for things like your visit tests run or. Health Savings Accounts HSAs.

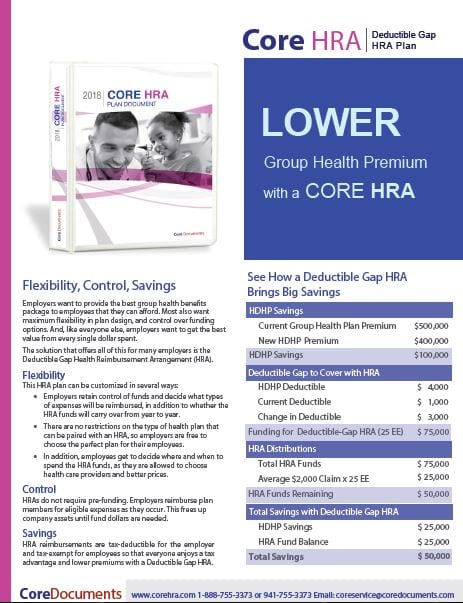

More commonly known as a Health Reimbursement Account an HRA is an employer-funded tax-advantaged employer health benefit plan. It provides coverage for medical dental vision and pharmaceutical costs. Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses.

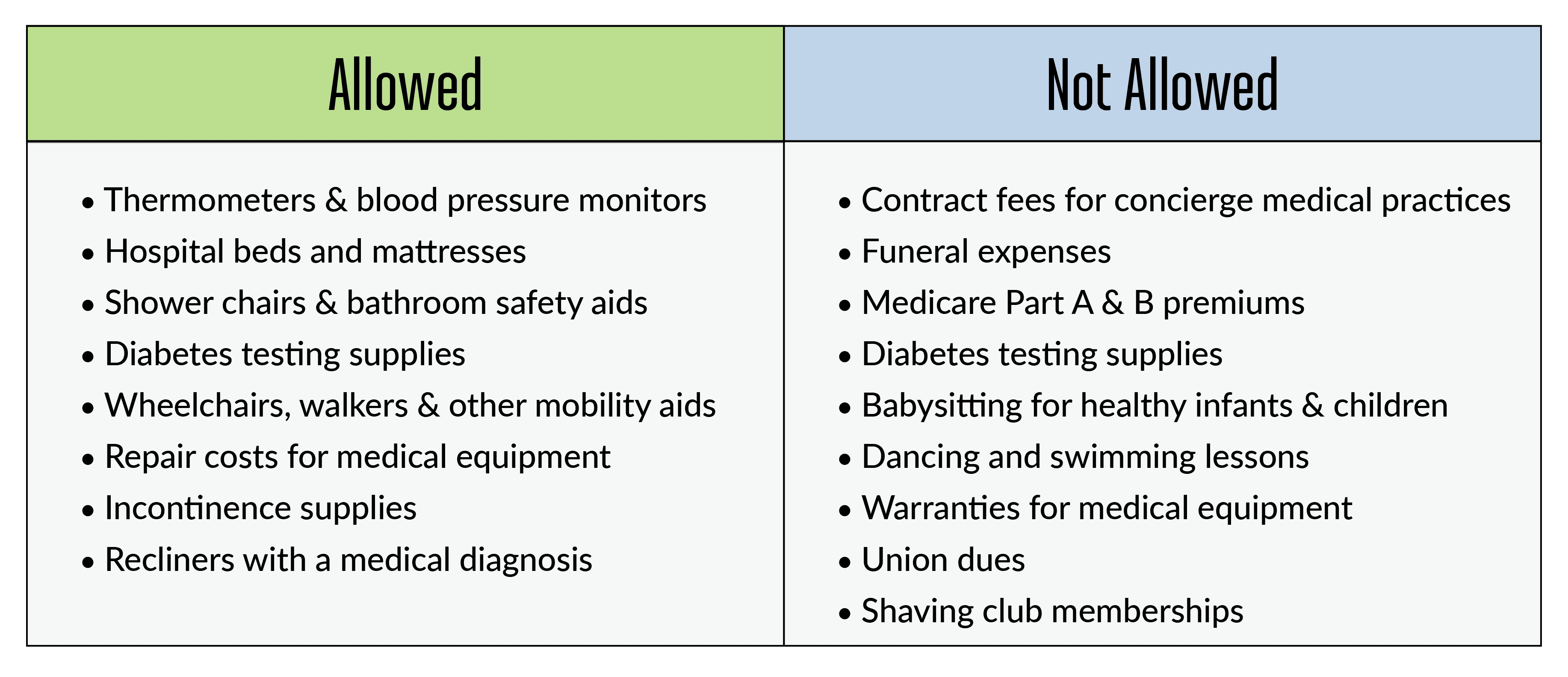

Medical expenses are the costs of diagnosis cure mitigation treatment or prevention of disease and the costs for treatments affecting any part or. But its important to know which expenses can be reimbursed. The following is a summary of common expenses claimed against Health Savings Accounts HSAs Health Reimbursement Arrangements HRAs Healthcare Flexible Spending Accounts HC-FSAs and Dependent Care FSAs DC-FSAs.

Cosmetic surgery or procedures. Most workplaces provide this form of FSA. The new CARES Act expands eligible expenses for HSAs FSAs and HRAs.

Maximize the Value of Your Reimbursement AccountMaximize the Value of Your Reimbursement Account ---- Your Health Care Flexible Spending Account FSA andor Health Reimbursement Account HRA dollars can be used for a variety of out-of-pocket health care expenses that qualify as federal income tax deductions under Section 213d of the. An HRA is an employer-funded plan that. Read the claim form closely and call us at 1 800 244-6224 if you have questions.

You can use your Health Care FSA HC FSA funds to pay. You can use your account to pay for a variety of healthcare products and services for you your spouse and your dependents. The IRS determines medical dental and vision expenses that are eligible with a health care FSA as well as a medical HRA that allows eligible items as listed in IRS publication 502.

A flexible spending account FSA is offered through many employer benefit plans and allows you to set aside pretax money for eligible health. An eligible HRA expense is any healthcare expense incurred by an employee their spouse or dependent that is approved by the IRS and eligible for reimbursement under your specific company plan. If you are unsure of what your Health Care FSA andor HRA dollars may be used for please contact your Plan Administrator.

Expenses that primarily prevent treat diagnose or alleviate a physical or mental defect or illness are eligible. Please note that ONLY dental and vision expenses are eligible for a Limited Purpose FSA. The IRS has strict rules on how FSAHRA expenses can be paid so its really important to follow the instructions on your Health Care Reimbursement Form.

Vantages to offset health care costs. Which costs are qualified for reimbursement is determined by the IRS. It is not eligible for reimbursement from an FSA HRA or HSA.

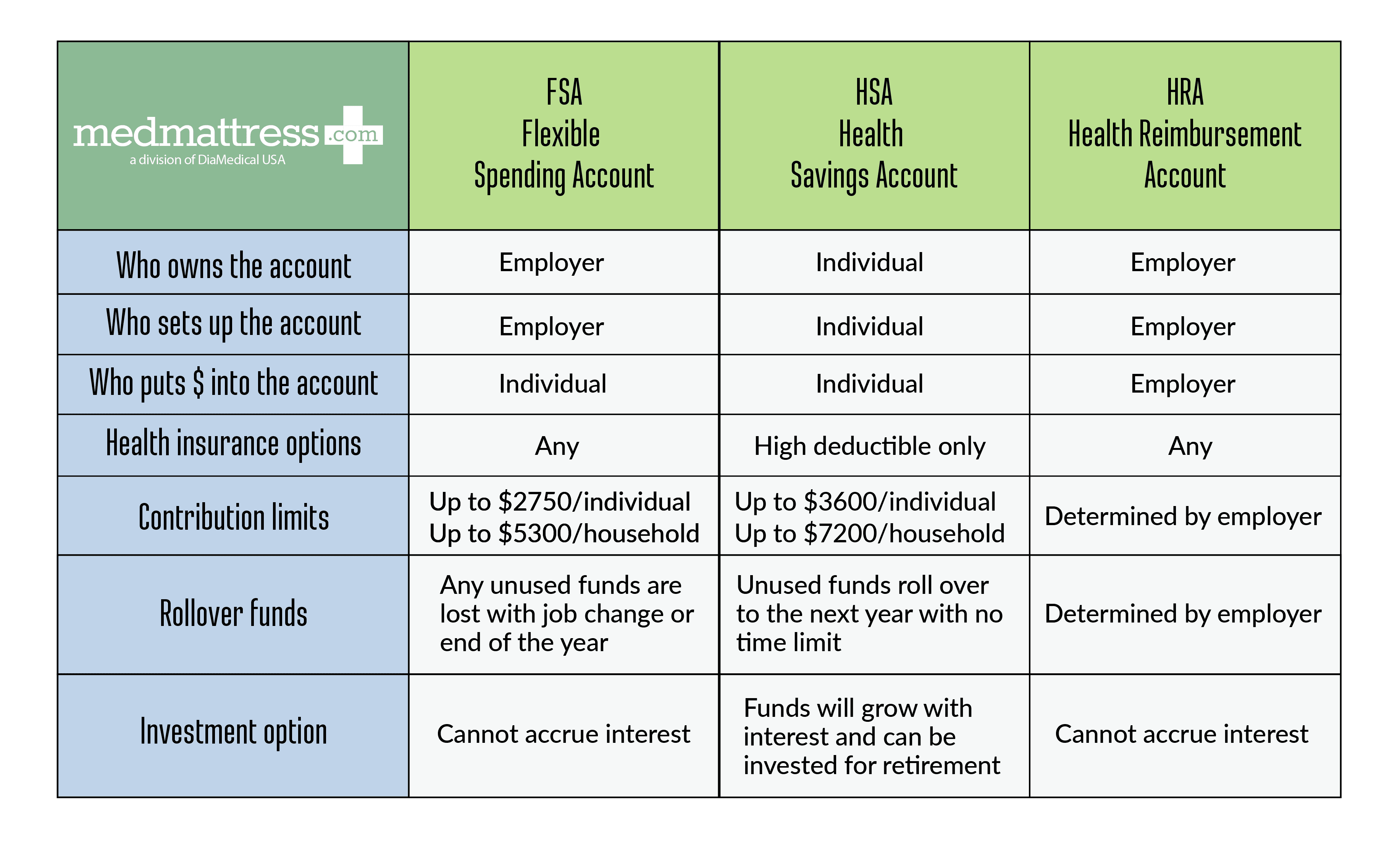

Medical FSA HRA HSA. To download the appropriate Health Care Reimbursement Request Form visit Customer Forms. Health Reimbursement Accounts HRAs Health Savings Accounts HSAs and Flexible Spending Accounts FSAs can be great cost-savings tools.

Health plan co-payments dental treatment and orthodontia eyeglasses and contact lenses and prescriptions are all eligible costs. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. Your employer determines which expenses are eligible for reimbursement based on a list of IRS-approved eligible expenses.

Due to frequent updates to the regulations governing these accounts and arrangements this list does not guarantee. An HRA is funded solely by the employer and the reimbursements for medical expenses up to a maximum dollar amount for a coverage period arent included in your income. FSA is flexible spending account or arrangement.

An employer may limit which expenses are allowable under their Health Care FSA or HRA plan. What are qualified HRA expenses. Here is a sample list of expenses currently eligible and not eligible by the.

When the expense has both medical and cosmetic purposes eg Retin-A which can be used to treat both acne and wrinkles a note from a medical practitioner recommending the item to treat a specific medical condition is required. Exercise and fitness programs for general health. You can use them to reimburse yourself for eligible health care dental and dependent care expenses.

Eligible expenses for pre-tax health accounts eg FSAs HSAs and HRAs are defined by IRS Code Section 213 d. You can view a comprehensive list of eligible expenses by logging into your WageWorks account. Your employer contributed 100 of the funds in this account and you as the employee cannot contribute to this account.

16 rows Various Eligible Expenses. HRA is health reimbursement account or arrangement. Some ineligible expenses examples.

Expenses that are for personal care cosmetic or general health purposes are not eligible. In addition if your. Although the rules for deductibility overlap in many respects with the rules governing health FSA HRA and HSA reimbursement there are some important differences.

The cost of routine skin care face creams etc does not qualify.

Hra Health Reimbursement Account 360peo Inc

Health Reimbursement Arrangement Hra B3pa

/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

Health Reimbursement Arrange Vs Health Savings Acct

Health Insurance 101 Hsa Fsa Hra

:max_bytes(150000):strip_icc()/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

Health Reimbursement Arrange Vs Health Savings Acct

Health Care Consumerism Hsas And Hras

/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

Health Reimbursement Arrange Vs Health Savings Acct

Health Reimbursement Arrangement Hra What Is It Health Health And Beauty Arrangement

A Comparison Chart Of Health Spending Accounts Hsas Vs Hras Vs Fsas Council For Affordable Health Coverage

Understanding The Differences Of Fsa Hsa Hra Accounts Medmattress Com

Comparing Hsas Hras And Fsas Which Approach Is Best Exude

Fsa Hra Hsa Eligible And Ineligible Expenses Cigna Hsa Health Savings Account Expensive

Understanding The Differences Of Fsa Hsa Hra Accounts Medmattress Com

Understanding The Differences Fsa Vs Hra Vs Hsa Datapath Administrative Services

What You Need To Know About Hsas Hras And Fsas Anthem

Hra Vs Fsa See The Benefits Of Each Wex Inc

Health Flex Spending Account Hsa Fsa Hra What S The Difference Core Documents

Hra Health Reimbursement Account Millennium Medical Solutions Inc

Understanding The Differences Of Fsa Hsa Hra Accounts Medmattress Com